Keep your cargo sailing smoothly, with valuable insights from our Asia-Pacific Market Update for January

The global demand outlook shows little sign of any short-term improvement. The developed nations are still facing inflationary and recessionary pressures which is dampening the outlook in Asia. Container demand has continued to fall with volumes back to pre-pandemic levels.

But there may be reasons for optimism. The ending of China’s rigid COVID-19 restrictions, while leading to a surge in new cases in the near-term, has also led to predictions of a surge in demand and trade from the second half of 2023. Looking to the future, Maersk is also investing $174 million in a green and smart warehouse complex in Shanghai’s Lingang district to cope with future global and regional logistics demand.

If there are new topics you would like to talk about, please let us know by filling out our survey from here.

Market Trends

Key manufacturing indicators remained largely flat in December and the short-term outlook remains depressed. Both the Global Composite Purchasing Manager’s Index (PMI) and global manufacturing orders were virtually unchanged in December compared with November, with the Global PMI standing at 48.2 compared with 48.0 in November. The manufacturing orders-to-inventory ratio stabilized in December at 0.93. The global PMI has trended lower throughout 2022 indicating a period of softer growth.

While inflation in the US and Europe appears to have peaked, partly due to lower energy costs, current levels remain elevated which coupled with recessionary pressures still present in North America and Europe could dampen the short-term outlook.

China’s re-opening could spur an economic rebound in the second half of this year with pent-up demand for overseas travel already emerging although the current surge in COVID-19 cases could lead to less activity in the next few months. Overall, there is little indication of a positive change in outlook, at least in the short-term.

Trade Outlook

Latest figures show global container volumes fell 7.9% between August-October against a year earlier. That compared with a year-on-year drop of 4.3% in the July-September period. North American containerized imports continued to fall, sliding by 15.9% between August-October from the 2021 period, while exports from Asia to the rest of the world slumped 11.8%.

Intra-Asia volumes, which have previously been resilient, dropped 7% in August-October. Volumes in Oceania – Australia and New Zealand – continued to defy declining volumes on the major global trades after export volumes rose 7.4% year-on-year between August-October, while imports climbed 2.9%.

There was also brighter news on port delays with congestion levels at US west coast and Europe ports almost back to pre-pandemic levels and while US east coast ports remain congested delays are easing. But the current surge in COVID-19 cases in China coupled with the extended Lunar New Year holiday could lead to delays at China’s main port gateways.

Ocean Update

As markets remain volatile, we’re ready to adjust to sudden shifts in inbound and outbound business.

Morten Juul

Asia Pacific Regional Head of Ocean Management

Maersk will continue to make capacity adjustments on services to North America, Europe and the Mediterranean over the next several weeks due to reduced demand actuations as a result of the Lunar New Year holidays. These include blank sailings and rebooking cargo on alternative services. Our overall goal remains to provide our customers with predictability and to ensure minimal disruption to their supply chain by supplying alternative routings and coverage for the affected vessel positions.

Full details of the changes are available on our advisories page here: Advisories | News & Advisories |Maersk

Key Market Outlook Across Trade Lanes

| Trade | Trade Statement | The most critical destination port situation update |

|---|---|---|

| Asia Pacific – North Europe | Market demand picked up before Chinese New Year although it is expected to slow after the holidays.We will continue to make incidental network adjustments while minimizing the impact to our customers’ schedules. | Operating performance at ports in Europe is stable.Operations at Rotterdam are back to normal after a new Collective Labor Agreement (CLA) was agreed. |

| Asia Pacific – Mediterranean | Space from Asia to the Mediterranean is available.We reinstated the previous blank sailing on the AE11 service (MSC Amelia) in the second half of January in response to demand.Port congestion at several Mediterranean destinations including Valencia, Piraeus, Haifa and Rijeka improved in January.We will continue to make incidental network adjustments while minimizing impact to our customers’ schedules if vessels are delayed by congestion. | Below ports face 2-3 days of delay: Sines, Lisbon, Leixoes, Portugal: Terminal affected by a pilot strike has caused some delay and congestion.Trieste, Italy: High yard density is leading to an extra two days berthing delay.Koper, Slovenia: There is up to a 2-day delay in berthing due to high yard density. |

| Asia Pacific – North America | Space is generally available from Asia Pacific to North America. There has been a significant improvement in port congestion at Oakland with the waiting time reduced from 15 to just 3 days.Severe winter weather, including strong winds and snow at Prince Rupert and Vancouver has disrupted terminal operations at both ports. The waiting time at Vancouver has increased from zero to 6 days with another 5 days waiting time to inland locations due to rail dwell delays. At Prince Rupert, the waiting time is around 4 days, from zero earlier, with an extra 12 days wait for onward rail connections.We are closely monitoring the weather situation to ensure we can provide a stable service. | Overall USEC ports: 1-3 days waiting times Savannah: 2-4 days Houston: 3-5 days Los Angeles/Long beach: 0-1 day waiting time Oakland: 0-3 days Seattle: 1 day Prince Rupert: 4 days Vancouver: 6 days |

| Asia Pacific – Latin America | The COVID-19 situation at Asia’s main ports is under control and there is sufficient space and equipment within the overall network to cater for more volume. We will continue to take a proactive approach to make sure the key corridors are well covered by alternative solutions in case of any service bottleneck.SPOT remains the platform for fast and accurate quotes with market relevant rates. | Overall operating normally. |

| Asia Pacific – West Central Asia | Demand to Middle East and India/ Pakistan was healthy before Chinese New Year. Overall, we have product and space available to cater more volume. | Overall operating normally |

| Asia Pacific – Africa | Volume picked up before Chinese New Year but is expected to revert to the traditional slack reason during the holiday.We will take this opportunity to reshuffle the network with some vessels sliding and blanking based on the market demand.Waiting times at destination ports have improved dramatically and most ports in West, East and South Africa are running smoothly. Only the few ports listed are facing congestion or crane maintenance. | Waiting time: Kribi: 2-4 days Matadi: 4-5 days Nouadhibou: 1-2 days Dar Es Salaam: 8 days Zanzibar: 1 4-21 days |

| Asia Pacific – Oceania | Asia to Australia market shows relatively strong demand in January despite the impact of COVID-19 in China.SPOT remains the platform to enable fast and accurate quote with market relevant rates. | |

| Oceania – World | We are offering an additional three free days for imports into China Mainland, Taiwan and Hong Kong between January 21-23. We also have an extra loader – SC Montreal – calling Sydney and Tanjung Pelepas to avoid cargo delays. The Australia-India Economic Cooperation and Trade Agreement has entered into force with tariffs on certain commodities reduced or removed from January 1st. New Zealand continues to experience weather related schedule delays. Our hub and spoke service is minimizing this impact on your supply chain. Service reliability for Oceania has improved significantly for all carriers compared with 2021. Latest reports Maersk’s reliability has improved by 38.4%, making up the top performer, compared with the industry average of a 21.7% improvement in schedule reliability. | Tauranga waiting time: 0.5-3 days.Australia ports: No delay for on-time |

| Import – Asia Pacific | The situation for Asia’s main ports’ is under control and we have open space on almost all trades into Asia.Labor shortages due to the rapid spready of COVID-19 in China in early January increased wait times, although this is expected to be back to normal with an average 1-2 days wait at most ports in China from the second half of January.Nucleic acid tests were cancelled from January 8 for import reefer cargo into China, according to China customs.We offer end-to-end integrated solutions with ocean and logistics services to help you better manage your supply chain. Should you have any interest, please feel free to contact your sales representative. | There is a container imbalance at Keelung port so we encourage you to place more dry cargo bookings into Kaohsiung to balance the situation.North-East Asia and South East Asia feeder capacities are mostly open. Manila Terminal reefer utilization reach critical levels due to slow cargo withdrawal. This could impact bookings with 3-5 weeks delay. |

| Intra – Asia | Capacity rationalization is planned for intra-Asia from the end-January to early February to balance slack demand during the Lunar New Year. All products coverage will be maintained through alternative routings. | Port congestion is causing ships to wait longer for berths in China, and to some extent in Philippines. Maersk is monitoring the situation and making schedule recovery plans to protect the reliability of future voyages. |

Monthly Vertical Insight: Reefer

Despite efforts by the Food and Agriculture Organization of the United Nations (FAO) to end world hunger and malnutrition by 2030, challenges have grown during the past years of the pandemic and global political instability. The unfortunate fact is that more than one-third of the world suffers from moderate to severe food insecurity, according to an annual report released by the FAO in 2021. At the same time, there is a high degree of lost and wasted food, creating a painful disparity.

The United Nations Environment Programme’s ‘Worldwide Food Waste’ findings report that roughly one-third of all food produced annually for human consumption is lost or wasted. Amongst those losses are common reefer container cargo, as fruits and vegetables ranked highest, with forty to fifty percent of all farmer’s yields reaching the bin instead of the refrigerators of end consumers. The COVID-19 crisis is creating uncertainty in the market by slowing down the logistics services, thus hampering business growth and increasing panic among the customer segments. The governments across different regions announced total lockdown and temporarily shut down of industries, leading to the border closures that restricted the movement of transportation & logistics services.

There are many reasons why food may be wasted in the supply chain; enroute, in retail, or with the end consumer. Unfortunately, the FAO has been able to trace forty percent of all food waste to the supply chain itself. Obviously, in an ideal world, no food would be wasted on the journey from farms to the plates of consumers, especially when there is such a high need for food around the world. However, it is not only food that is being wasted when it comes to cold chain logistics.

The global business outlook has changed dramatically post COVID-19 health crisis. Currently, the world is returning back to normal with significant recovery in product sales which may start to influence the cold chain logistics market positively.

During 2014-2019, Asia-Pacific (APAC) dominated the reefer container market, and it will continue doing so till 2030. The global cold chain logistics market was worth almost 248.4 billion U.S. dollars in 2020 and is expected to exceed 410 billion U.S. dollars by 2028.

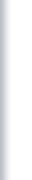

The global cold chain logistics market was valued at $202.17 billion in 2020, and is projected to reach $782.27 billion by 2030, registering a CAGR of 14.6% from 2021 to 2030, with Drugs & Pharmaceuticals projected as the most lucrative segments.

Cold chain logistics places a substantial burden on the environment as refrigeration is a source of greenhouse gases and is energy-intensive. The increasing number of refrigerated road transportation is contributing to this burden and thus climate change. Therefore, environmental concerns regarding greenhouse gas emissions are anticipated to hinder the market growth of cold chain logistics.

Click here to see how digitalization can revolutionize waste in the reefer container industry.

Air Update

Global air cargo markets continued to soften in November with international demand falling by 14.2%, according to the latest figures from the International Air Transport Association (IATA) published in early January.

Asia-Pacific was the worst performing region with Asia airlines seeing an 18.6% fall in air cargo volumes in November compared to the same month in 2021. That compared with a 14.7% drop in demand in October. “Airlines in the region continue to be impacted by lower levels of trade and manufacturing activity and disruptions in supply chains due to China’s rising COVID cases,” IATA said in a statement.

By comparison, while North American and European airlines also saw a year-on-year fall in airfreight volumes, the percentage decrease was an improvement over October, IATA said. North American carriers posted a 6.6% year-on-year decrease in cargo volumes in November, but this compared with an 8.6% drop in October. Similarly, while saw a 16.5% decrease in cargo volumes in November against November 2021, that compared with an 18.8% fall in October.

Maersk Greater China:

Carriers including Air China, China Southern Airlines and China Cargo Airlines are cancelling flights to Europe and the US to match demand with capacity during and after the Lunar New Year holidays.

Ground handling operations returned to normal by mid-January after delays at several airports in December caused by a surge in COVID-19 cases following the lifting of COVID-related quarantine restrictions.

Indonesia, Philippines:

Air cargo demand is expected to slow further in Q1 as the ocean freight markets normalize. Space to Europe and the US will remain stable and manageable.

Airfreight shipments of electronics and semiconductors remain stable from the Philippines to Europe.

We don’t expect much impact on exports from Indonesia and the Philippines due to the Lunar New Year holidays although there could be some space constraints at air cargo hubs.

Japan:

OCS announced on December 21 that pharmaceutical shipments to China have been banned from being shipped as express freight under local import customs regulations. Items sent express will be confiscated by customs. OCS said pharmaceuticals should not be mixed with other cargo because customs clearance will be delay. OCS issued the warning after it saw a surge in inquiries on whether it could ship over-the-counter drugs such as antipyretics and analgesics, and antigen test kits.

Narita airport’s three main cargo handlers including Japan Airlines, All Nippon Airways, Nippon Cargo Airlines, saw a fifth straight month of volume declines in November. Imports and exports have fallen significantly since 2021 and the decline in imports has been particularly pronounced, probably due to the impact of the weaker yen. All Nippon Airways saw the largest drop with a 30% fall in total year-on-year volumes in November.

Vietnam:

Low air cargo demand in January is leading airlines to cancel flights, with little change from the previous month.

Inland Services Update

Maersk Greater China: Maersk is set to build its first green and smart flagship logistics center in China, a $174 million, 113,000 sq m complex in the Lingang area of the Shanghai Free Trade Zone, close to Yangshan deepwater port. The facility is expected to start operations in Q3 2024.

The logistics centre is designed to have 150,000 sq m of warehousing spread over four ramped threestorey warehouses and one 24 m high warehouse with automated storage and retrieval system (AS/RS). It will provide customers with a wide range of integrated logistics services, including international export consolidation, regional and global order fulfillment and distribution, cross border e-commerce and other value-added logistics services.

“Shanghai plays a critical role for Maersk global network. With Lingang’s proximity to Yangshan port and its favorable free trade policies, our flagship logistics centre will provide agile and sustainable solutions, connecting and simplifying our customers’ supply chains,” said Caroline Wu, Managing Director of Maersk Greater China.

Inland capacity for trucking and rail remains stable while some of our barge services in South China maybe suspended from mid-January due to the Lunar New Year holidays.

Maersk launched a new Sea-Rail corridor between Urumqi and Tianjin in early January as an addition to our intermodal network in northwest China.

Imports of pharmaceutical and consumer goods are among more than 1,000 products benefitting from lower provisional import tariffs introduced from January 1. The reduced tariffs will apply to products including coffee makers, juicers and cashew nuts.

Philippines: Maersk resumed accepting reefer imports from mid-January at the Manila North terminal, albeit in limited volumes, following improved yard utilization. Terminals also recovered from Christmas and New Year holiday closures. Waiting time at the Manila terminals is now averaging 1-2 days, while Batangas and Subic are allowing berthing on arrival.

Japan: Container drayage capacity is stable and the market has recovered after the New Year holiday.

Major Ports Update

Vessel Waiting Time Indicator

| Less than 1 day | 1-3 days | More than 3 days | |

|---|---|---|---|

| Asia Ports | Xingang, Shanghai, Ningbo, Shekou, Xiamen, Yantian, Nansha, Chiwan, Hong Kong, Singapore, Tanjung Pelepas | Busan, Qingdao, Brisbane, Auckland, Lyttelton | Tauranga |

| Rest of World | Bremerhaven, Rotterdam, Felixstowe, Long Beach, Miami, Los Angeles, Apapa, Tin Can, Tema, Lome, Onne, Abijian, Dakar, Conakry, Maputo, Pointe Noire, Balboa | Newark, Savannah, Poti, Valencia, Sines, Luanda | Koper, Port Tangier, Oakland, Vancouver, Prince Rupert, Houston, Kribi, Matadi, Cape Town, Dar Es Salaam, Zanzibar |

Remark: Numbers are dynamic and subject to change.

![]()